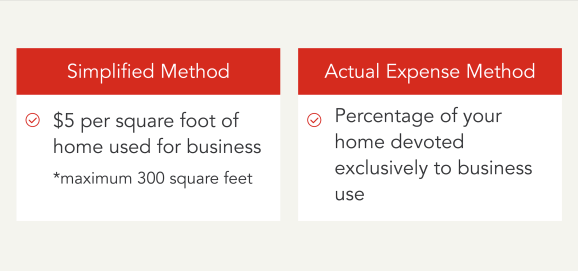

Simplified Home Office Deduction 2024 – If you qualify for the home office deduction, there are two ways to calculate the tax break, according to the IRS. The “simplified option” uses $5 per square foot of the portion of the home used, up . for a maximum deduction of $1,500. As long as your home office qualifies, you can take this tax break without having to keep records of specific expenses. “I like the (simplified method .

Simplified Home Office Deduction 2024

Source : blog.taxact.comHome Office Deduction: How It Works, Who Can Take It NerdWallet

Source : www.nerdwallet.comDo I Qualify for the Home Office Deduction? Intuit TurboTax Blog

Source : blog.turbotax.intuit.comHome Office Deduction: How It Works, Who Can Take It NerdWallet

Source : www.nerdwallet.comHere’s who qualifies for the home office deduction for 2023 taxes

Source : www.cnbc.comHome Office Tax Deduction 2024 Blog Akaunting

Source : akaunting.comHow Working from Home Affects Income Taxes & Deductions (2023 2024)

Source : www.debt.orgHere’s who qualifies for the home office deduction for 2023 taxes

Source : www.cnbc.comTop 10 Tax Deductions to Claim for 2024 Chime

Source : www.chime.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comSimplified Home Office Deduction 2024 Home Office Tax Deduction in 2024 New Updates | TaxAct: You can calculate the home office deduction in one of two ways: the simplified option or the regular method. As CNBC said, “the simplified option uses a standard deduction of $5 per square foot of . The Internal Revenue Service allows business owners to take the tax deduction two different ways. The simplified option, which was introduced in 2013, allows entrepreneurs to deduct $5 per square foot .

]]>