Business Expense Deductions 2024 – you can opt to itemize deductions for certain expenses, including things like property taxes, mortgage interest, business expenses, and interest paid on student loans. There are more ways to lower . Discover how self-employed individuals and employees can claim cellphone expenses as a tax deduction, and how the rules have changed over the years. .

Business Expense Deductions 2024

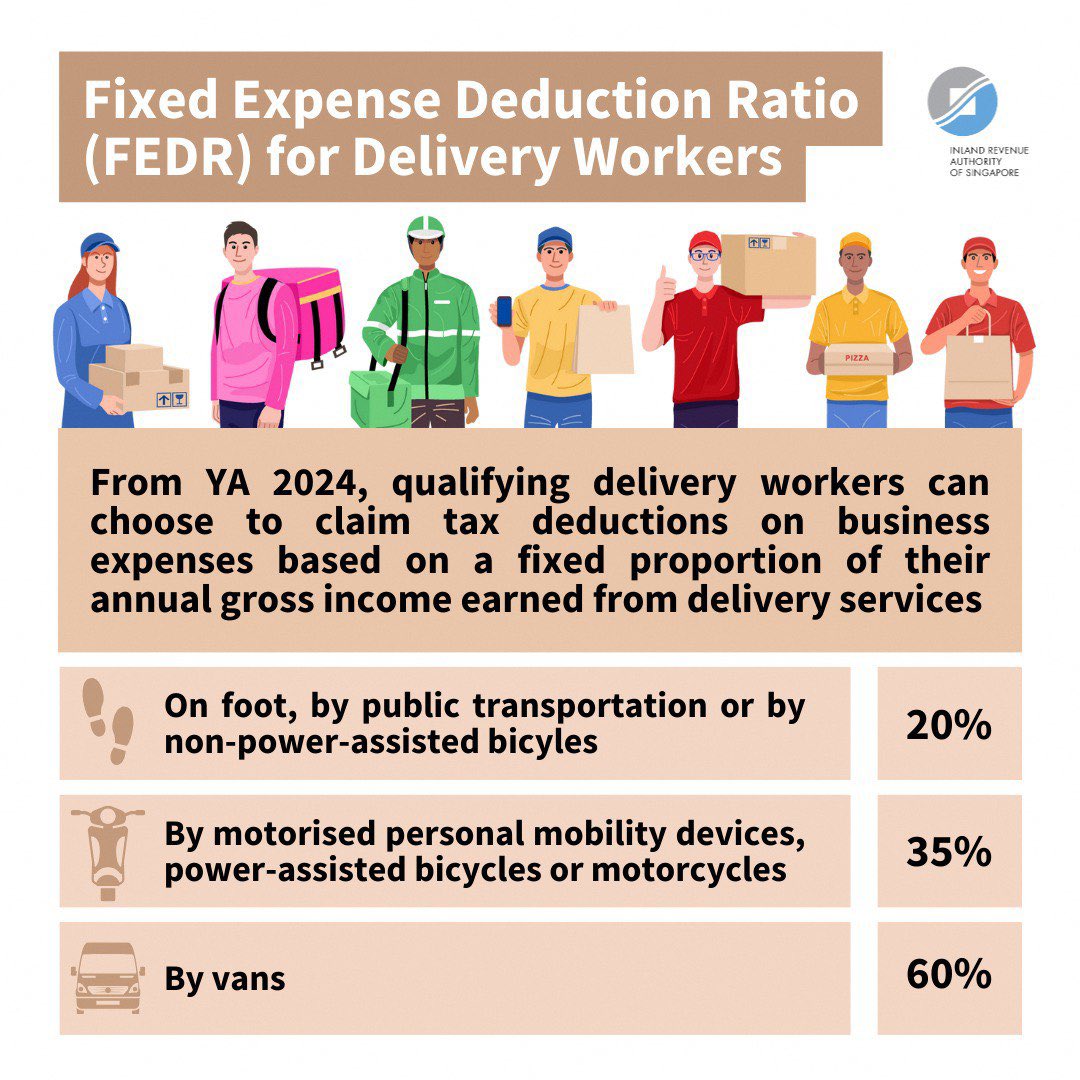

Source : www.freshbooks.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

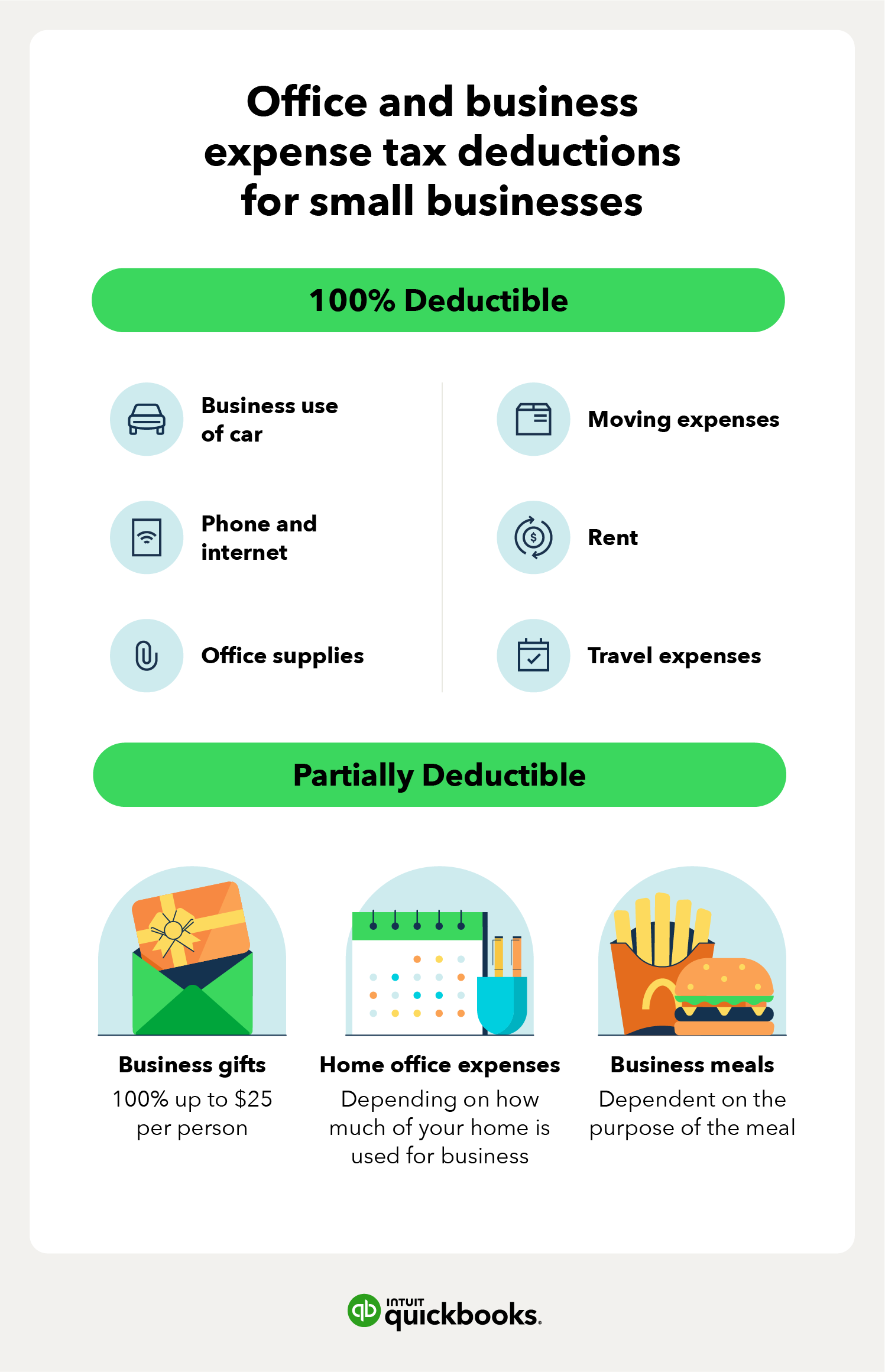

Source : twitter.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com22 Small Business Tax Deductions Checklist For Your Return In 2024

Source : www.insureon.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

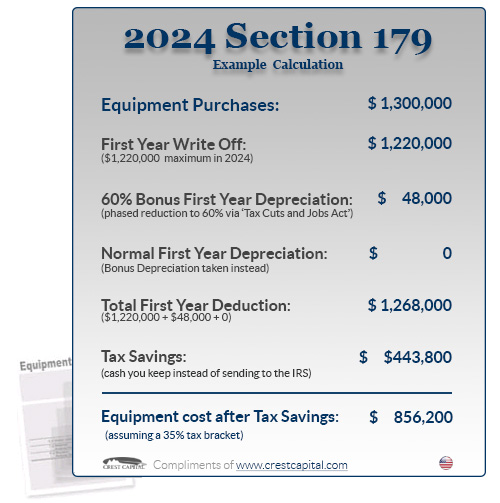

Source : akaunting.comSection 179 Deduction – Section179.Org

Source : www.section179.org2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item

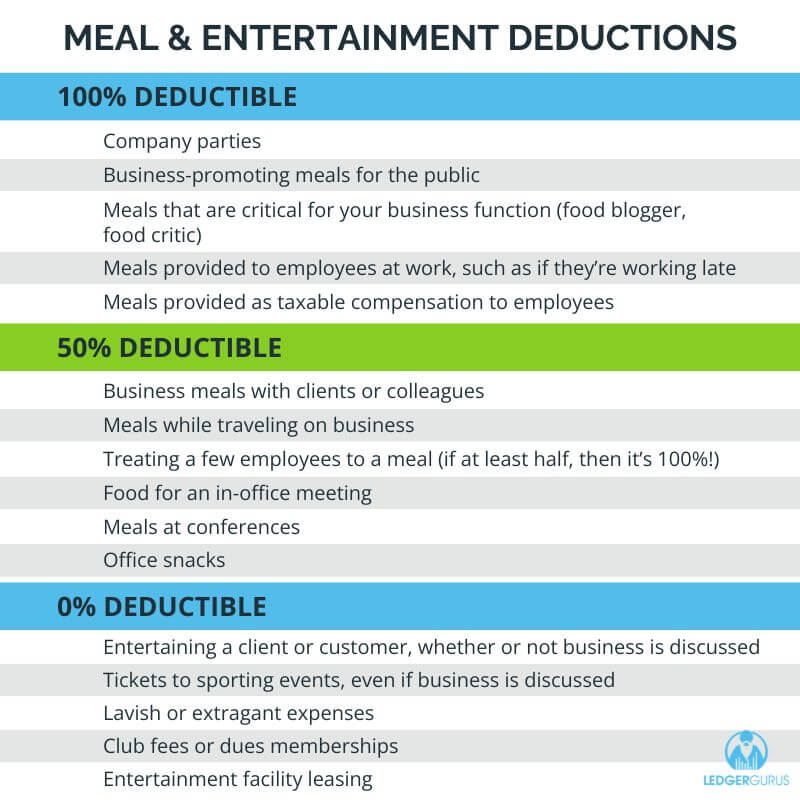

Source : www.tangiblevalues.comMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comBusiness Expense Deductions 2024 25 Small Business Tax Deductions To Know in 2024: Basically, taxpayers must prove the items were necessary or a legitimate business expense. They can’t be personal expenses. Here are examples of extraordinary deductions taxpayers have asked . Planes at a private jet terminal this in Las Vegas. (John Locher/AP) Business executives have been using corporate planes for personal vacation travel and illegally writing off the flights as .

]]>