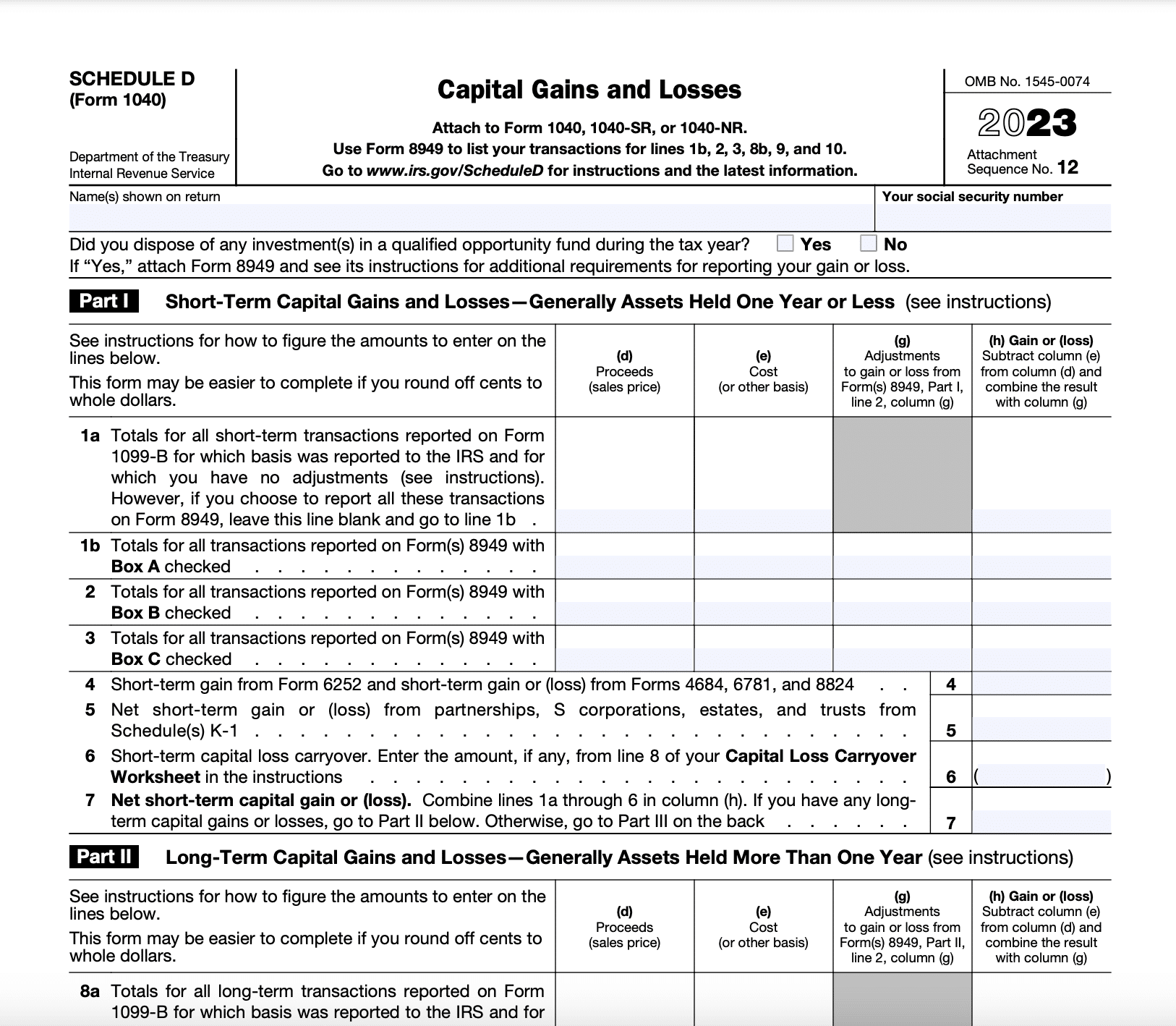

2024 Schedule D Tax Worksheet – Depending on your answers to the various Schedule D questions, you’re directed to the separate Qualified Dividends and Capital Gain Tax worksheet or the Schedule D Tax worksheet, which are found in . Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can expect to receive your refund based on when you .

2024 Schedule D Tax Worksheet

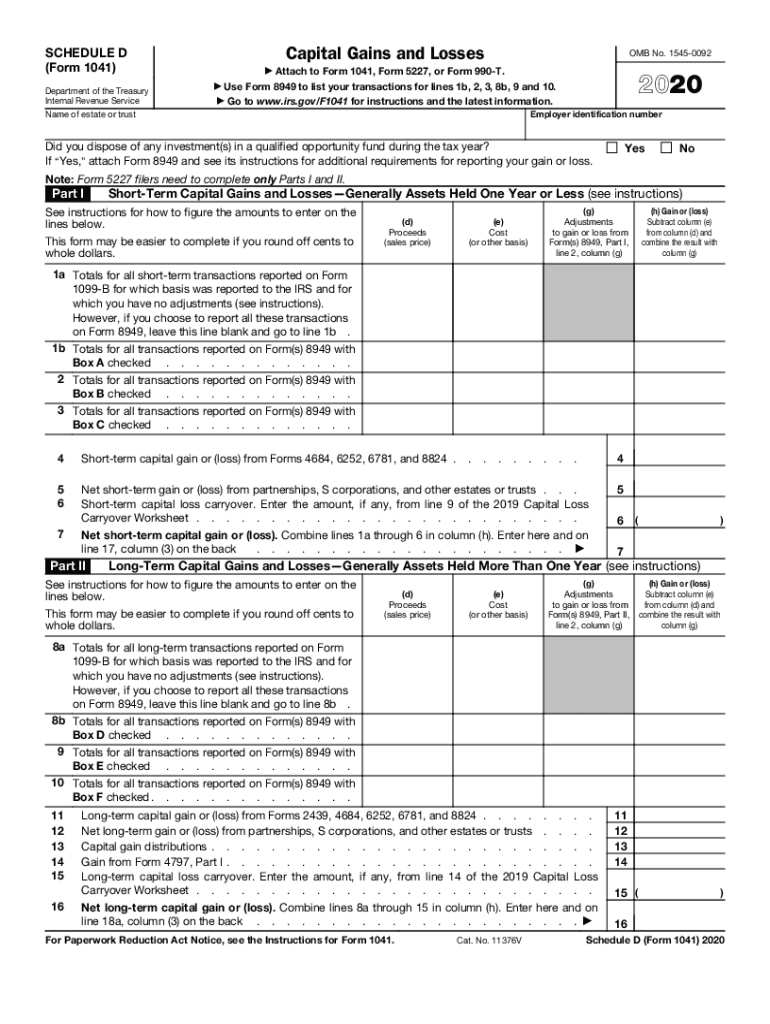

Source : www.dochub.comPublication 505 (2023), Tax Withholding and Estimated Tax

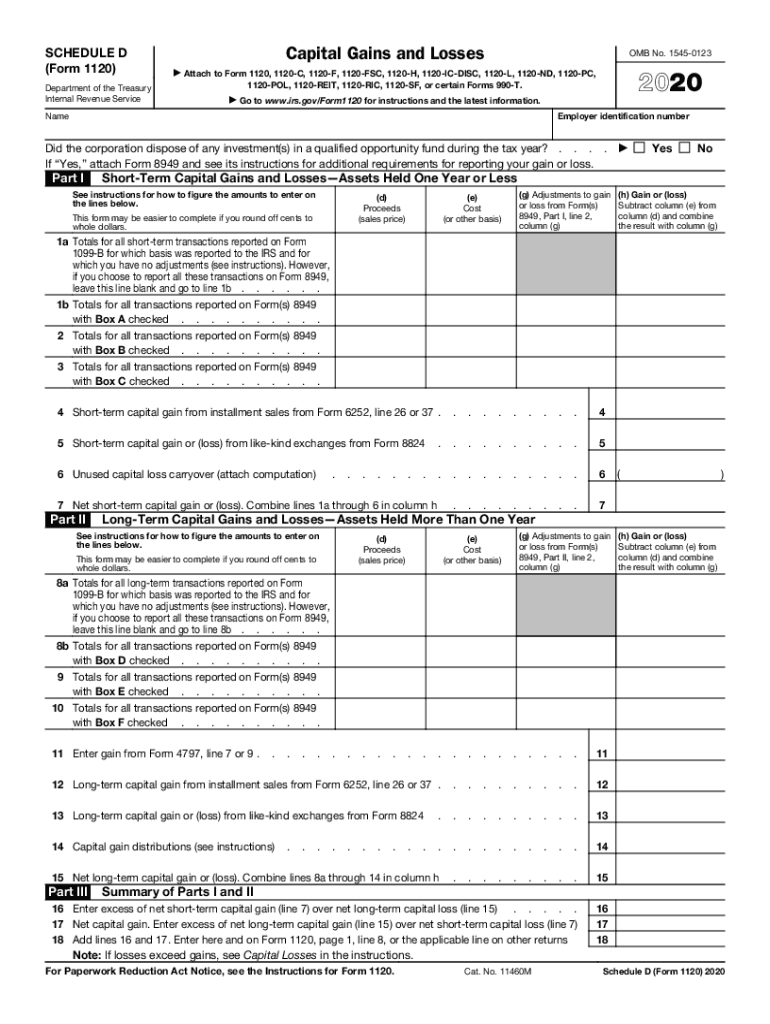

Source : www.irs.govSchedule d tax worksheet: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule d tax form: Fill out & sign online | DocHub

Source : www.dochub.comBusiness Tax Renewal Instructions | Los Angeles Office of Finance

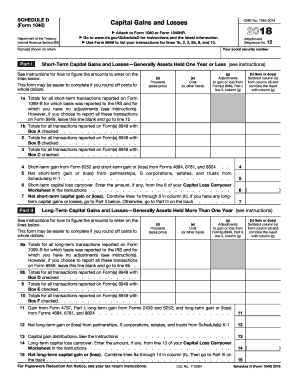

Source : finance.lacity.govIRS Schedule D (1040 form) | pdfFiller

Source : www.pdffiller.comCryptocurrency and Taxes: A Guide for the 2023 2024 US Tax Season

Source : cryptonews.comSchedule d: Fill out & sign online | DocHub

Source : www.dochub.comEstimated Taxes, Due Dates and Safe Harbor Tax Rules (2024)

Source : wallethacks.com2024 Schedule D Tax Worksheet Schedule d tax worksheet: Fill out & sign online | DocHub: The estimated IRS refund tax schedule for 2023 returns sheds light on when to expect your refund. Filing early can speed up the process, as the IRS typically begins accepting e-filed returns . For 2024, tax day falls on Monday, April 15, as is customary. Tax season officially started on Jan. 29, when the IRS began accepting Form 1040s for 2023. This means, most taxpayers have 11 weeks .

]]>